I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Entrée Resources. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Entrée Resources.

Entrée/Oyu Tolgoi JV

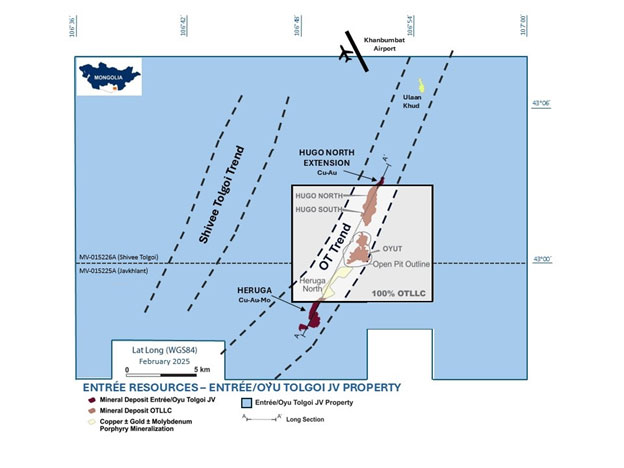

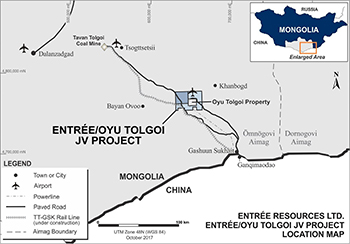

The Oyu Tolgoi project is one of the world’s largest new copper-gold mines and is located in the South Gobi region of Mongolia. The Oyu Tolgoi project comprises two separate land holdings: the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC, and the Oyu Tolgoi mining licence, which is held by OTLLC.

Entrée has a 20% participating interest in mineralization on the Entrée/Oyu Tolgoi JV Property extracted below 560 metres elevation, which includes all of the Hugo North Extension and Heruga deposits, and a 30% participating interest in mineralization identified above 560 metres elevation.

The Entrée/Oyu Tolgoi JV Property comprises the geographical area covered by the Shivee Tolgoi and Javkhlant mining licences. The Entrée/Oyu Tolgoi JV Property covers 62,920 hectares and hosts:

- Hugo North Extension Copper-Gold Porphyry Deposit, Lifts 1 and 2

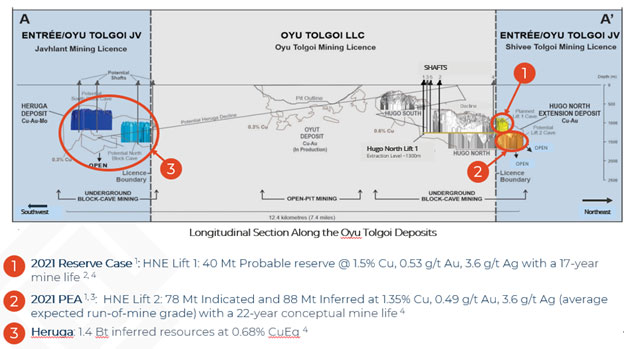

- Lift 1 is the upper portion of the Hugo North Extension copper-gold porphyry deposit and forms the basis of the 2021 Reserve Case. It is the northern portion of the Lift 1 Panel 1 underground block cave. Hugo North Extension Lift 1 Probable reserves include 40 million tonnes ("Mt") grading 1.54% copper, 0.53 grams per tonne ("g/t") gold, and 3.63 g/t silver.

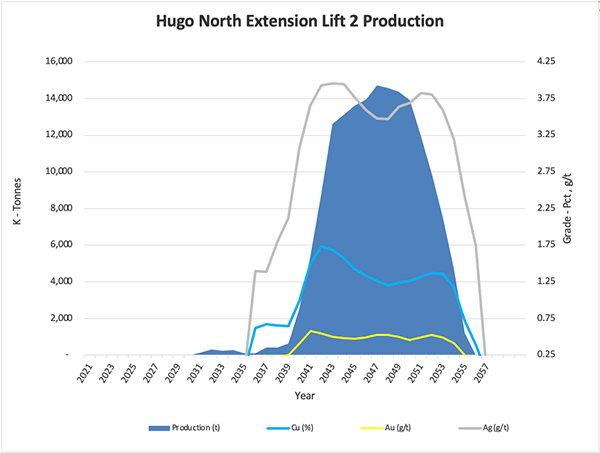

- Lift 2 is directly below and extends north beyond Lift 1 and is the next potential phase of underground mining on the Entrée/Oyu Tolgoi JV Property, once Lift 1 mining is complete. Mineral resources from Lift 2 form the basis of the 2021 PEA mine plan, which include: 78 Mt (Indicated) and 88 Mt (Inferred). The average expected run-of-mine feed grade of 1.35% copper, 0.49 g/t gold, and 3.6 g/t silver includes dilution and mine losses.

- Heruga Copper-Gold-Molybdenum Porphyry Deposit

- Heruga is the southernmost deposit at Oyu Tolgoi, ~93% of which occurs on the Entrée/Oyu Tolgoi JV Property. Inferred mineral resources include: 1,400 Mt grading 0.41% copper, 0.40 g/t gold, 1.5 g/t silver and 120 parts per million ("ppm") molybdenum. While Heruga is not included in the 2021 PEA, it provides opportunity for future exploration and potential development.

- A large prospective land package with numerous priority exploration targets.

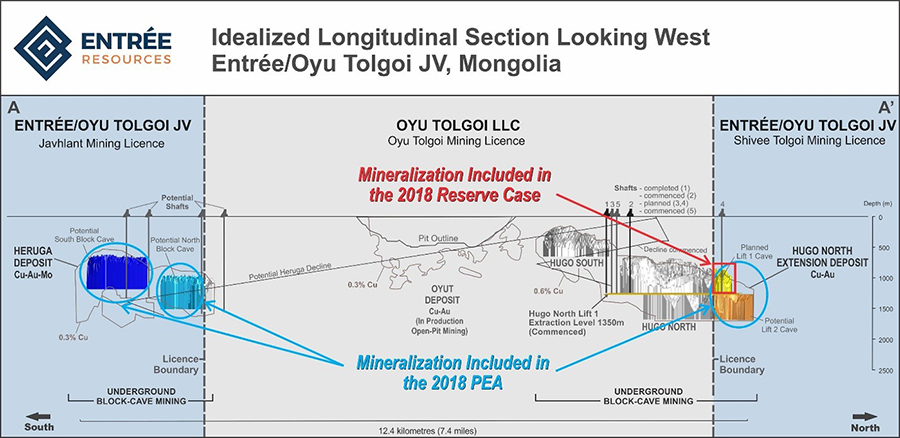

The 12.4-kilometre trend of porphyry deposits that comprise the Oyu Tolgoi project is shown below in a north-northeast oriented, west-looking longitudinal section (A-A’).

The Oyu Tolgoi mining licence is held by OTLLC (owned 66% by Rio Tinto and 34% by the Government of Mongolia). Rio Tinto is the operator of the existing open pit mine on the Oyu Tolgoi mining licence and is currently managing the ramp-up of the Hugo North (including Hugo North Extension) Lift 1 underground mine on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property.

Under the terms of the Entrée/Oyu Tolgoi JVA, Entrée has a 20% participating interest in mineralization extracted below 560 metres elevation, which includes all of the Hugo North Extension and Heruga deposits, and a 30% participating interest in mineralization identified above 560 metres elevation. OTLLC has the remaining 80% (or 70%) participating interest.

On June 6, 2025, the Company announced the Entrée/Oyu Tolgoi JV had paused development work on Hugo North Extension Lift 1 pending transfer of title to the Entrée/Oyu Tolgoi JV mining licences from Entrée LLC to OTLLC on behalf of the Entrée/Oyu Tolgoi JV participants. If Lift 1 Panel 1 lateral development work is significantly delayed, it could have an adverse effect (which could be material) on development costs and schedule, the business, assets, future cash flow, and financial condition of the Company, and the Company’s share price. See the Company’s news release dated June 6, 2025 titled, "Entrée Resources Announces Pause in Oyu Tolgoi Lift 1 Panel 1 Underground Development Work".

Robert Cinits, P.Geo., approved the scientific and technical information about the Entrée/Oyu Tolgoi JV Property on this website. Portions of the information are based on assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the Company’s most recently filed Management’s Discussion & Analysis and Annual Information Form, which are available on this website or on SEDAR+ (www.sedarplus.ca). The results of the 2021 Reserve Case and 2021 PEA can be found in the Technical Report that is filed on SEDAR+ and HERE.

The 2021 Reserve Case is discussed in a Technical Report titled, "Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report" with an original effective date of May 17, 2021 and an amended effective date of October 8, 2021. The 2021 Reserve Case is based on mineral reserves attributable to the Entrée/Oyu Tolgoi JV from Hugo North Extension Lift 1.

The Technical Report also includes the 2021 PEA on a conceptual Hugo North Extension Lift 2. The 2021 PEA is based on Indicated and Inferred mineral resources from Lift 2, as the second potential phase of development and mining on the Hugo North Extension deposit. Lift 2 is directly below and extends north beyond Lift 1. There is no overlap in the mineral reserves from the 2021 Reserve Case and the mineral resources from the 2021 PEA. Development and capital decisions will be required for the eventual development of Lift 2 once production commences at Hugo North Extension Lift 1.

LOM highlights of the production and financial results from the 2021 Reserve Case and the 2021 PEA are summarized below.

| Entrée/Oyu Tolgoi JV Property | Units | 2021 Reserve Case | 2021 PEA |

| Attributable Financial Results | |||

| Cash Flow, pre-tax | US$M | 449 | 1,982 |

| NPV(5%), after-tax | US$M | 185 | 541 |

| NPV(8%), after-tax | US$M | 131 | 306 |

| NPV(10%), after-tax | US$M | 104 | 213 |

| LOM Recovered Metal | |||

| Copper Recovered | Mlb | 1,249 | 4,564 |

| Gold Recovered | koz | 549 | 2,025 |

| Silver Recovered | koz | 3,836 | 15,067 |

| LOM Processed Material | |||

| Probable Reserve Feed | 40 Mt @ 1.54% Cu, 0.53 g/t Au, 3.63 g/t Ag | ---- | |

| Indicated Resource Feed | ---- | 77.9 Mt @ 1.35% Cu, 0.49 g/t Au, 3.6 g/t Ag (1.64% CuEq) | |

| Inferred Resource Feed | ---- | 87.8 Mt @ 1.35% Cu, 0.49 g/t Au, 3.6 g/t Ag (1.64% CuEq) |

Notes:

- Long term metal prices used in the net present value (NPV) economic analyses for the 2021 Reserve Case and the 2021 PEA are: Cu US$3.25/lb, Au US$1,591.00/oz, Ag US$21.08/oz.

- Mineral reserves in the 2021 Reserve Case, and mineral resources in the 2021 PEA mine plan are reported on a 100% basis.

- Entrée has a 20% interest in the above processed material and recovered metal.

- The mineral reserves that form the basis of the 2021 Reserve Case are from a separate portion of the Hugo North Extension deposit than the mineral resources in the 2021 PEA.

- Copper equivalent (CuEq) is calculated as shown in the mineral reserves and mineral resources statements on this website.

- 2021 Reserve Case cash flows are discounted to the beginning of 2021.

- 2021 PEA cash flows are discounted to the beginning of 2027, the assumed beginning of Hugo North Lift 2 development. Attributable Entrée/Oyu Tolgoi JV production is assumed to begin in 2031 and ramp-up to stable production in 2043. Final Entrée/Oyu Tolgoi JV attributable production is assumed to conclude in 2056.

- Indicated and Inferred resource average expected run-of-mine feed grade of 1.35% Cu, 0.49 g/t Au, and 3.6 g/t Ag (1.64% CuEq) includes dilution and mine losses.

The economic analysis in the 2021 PEA is based on a conceptual mine plan and does not have as high a level of certainty as the 2021 Reserve Case. The 2021 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2021 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both the 2021 Reserve Case and the 2021 PEA, Entrée is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other Oyu Tolgoi project areas owned 100% by Entrée’s joint venture partner, OTLLC. The production and cash flows from the 2021 Reserve Case and the 2021 PEA are from separate parts of the Hugo North Extension deposit and there is no overlap of the mineralization.

Both the 2021 Reserve Case and the 2021 PEA are based on information supplied by OTLLC or reported within OTFS20. The results of the 2021 Reserve Case and 2021 PEA can be found in the Technical Report that is filed on SEDAR+ and HERE.

Neither OTFS20 nor the results of the 2021 Reserve Case and 2021 PEA reflect the impacts of delays due to later than planned commencement of the Panel 0 undercut on the Oyu Tolgoi mining licence, lateral development scope changes, impacts of COVID-19 on development progression and delays to Shafts 3 and 4, which were commissioned during the third quarter 2024 and are required to provide ventilation to support production from Panels 1 and 2 during ramp-up. First development work on Hugo North Extension Lift 1 commenced in October 2024 but was paused in June 2025. The timing of any future development work in the Hugo North Extension deposit footprint is contingent upon the resolution of certain outstanding issues, including the transfer of the Shivee Tolgoi mining licence from the Company’s Mongolian subsidiary Entrée LLC to OTLLC. OTFS23, which includes the technical studies for Panels 1 and 2 mine design and schedule optimization, remains subject to acceptance by applicable regulatory bodies in Mongolia.

Key Financial Outputs

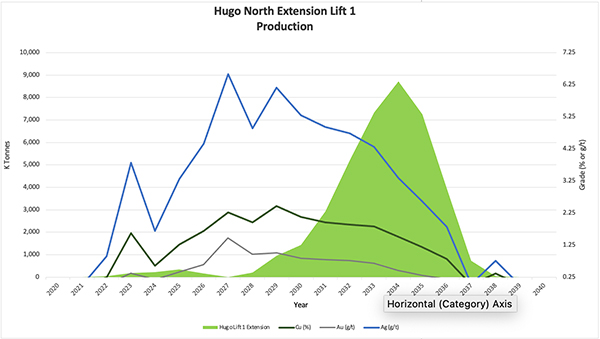

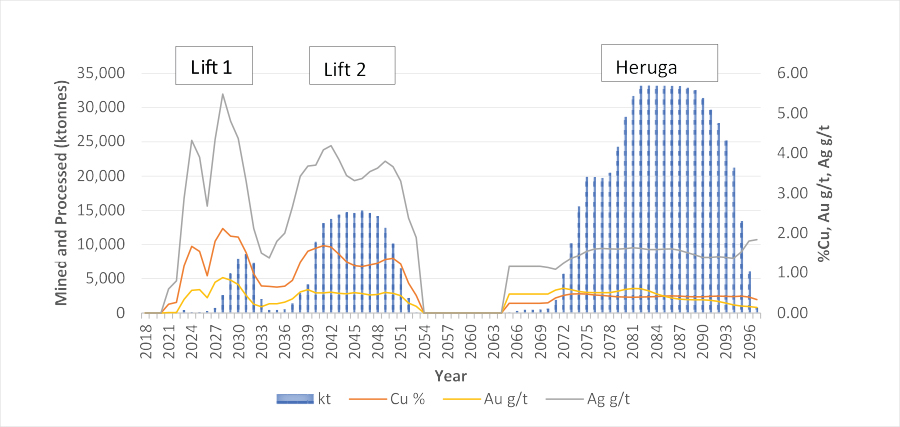

Does not reflect previously reported delays; corresponding years are scheduled to change based on OTFS23 and the timing of resolution of certain outstanding issues, including the transfer of the Shivee Tolgoi mining licence from Entrée LLC to OTLLC.

Key financial assumptions and outputs from the 2021 Reserve Case are as follows (reported on a 100% Entrée/Oyu Tolgoi JV basis unless otherwise noted; assumes long term metal prices of US$3.25 copper, US$1,591.00/oz gold and US$21.08/oz silver):

- Hugo North Extension Lift 1: 17-year Lift 1 mine life ("LOM") production (4-years development production and 13-years block cave production).

- Maximum production rate of approximately 25,000 tonnes per day ("tpd"), which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to supply a maximum mill throughput rate of 125,000 tpd.

- Total recovered metal over the LOM of Hugo North Extension Lift 1: 1,249,000 lbs copper, 549,000 oz gold, 3,836,000 oz silver.

- Total direct development and sustaining capital expenditures of approximately US$275.7 million (US$55.1 million attributable to Entrée).

- Entrée LOM average cash cost before credits US$1.57/lb payable copper.

- Entrée LOM average cash costs after credits ("C1") US$0.79/lb payable copper.

- Entrée LOM average all-in sustaining costs ("AISC") US$1.26/lb payable copper.

Notes: Entrée has a 20% attributable interest in the above processed material.

Does not reflect previously reported delays; corresponding years are scheduled to change based on OTFS23 and the timing of resolution of certain outstanding issues, including the transfer of the Shivee Tolgoi mining licence from Entrée LLC to OTLLC.

Key financial assumptions and outputs from the 2021 PEA are as follows (reported on a 100% Entrée/Oyu Tolgoi JV basis unless otherwise noted; assumes long term metal prices of US$3.25 copper, US$1,591.00/oz gold and US$21.08/oz silver):

- Hugo North Extension Lift 2: 22-year Lift 2 mine life (4-years development production and 18-years block cave production).

- Maximum production rate of approximately 40,500 tpd, which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to supply a maximum mill throughput rate of 125,000 tpd.

- Total metal production over the LOM of Hugo North Extension Lift 2: 4,564,000 lbs copper, 2,025,000 oz gold, 15,067,000 oz silver.

- Total direct development and sustaining capital expenditures of approximately US$1,589.6 million (US$319.7 million attributable to Entrée).

- Entrée LOM average cash cost before credits US$1.10/lb payable copper.

- Entrée LOM average C1 US$0.30/lb payable copper.

- Entrée LOM average AISC US$0.92/lb payable copper.

The 2021 Reserve Case and the 2021 PEA are mutually exclusive; if the 2021 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 is not sterilized or reduced in tonnage or grades. In addition, the Heruga deposit, which is not included in either the 2021 Reserve Case or the 2021 PEA, provides a great deal of future potential and with further exploration and development could become a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provide considerable flexibility for mine planning and development.

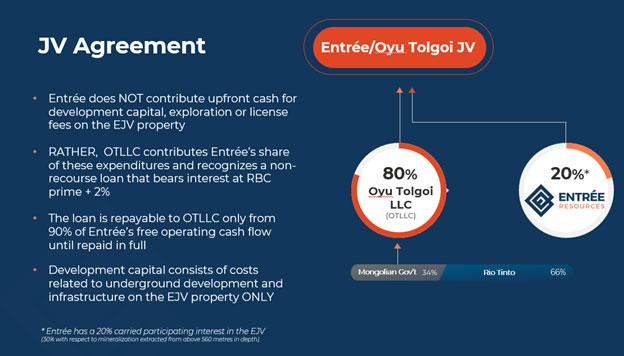

Capital and Operating Costs

Under the terms of the Entrée/Oyu Tolgoi JVA, OTLLC is responsible for 80% of all costs incurred on the Entrée/Oyu Tolgoi JV Property for the benefit of the Entrée/Oyu Tolgoi JV, including capital expenditures, and Entrée is responsible for the remaining 20%. In accordance with the terms of the JVA, Entrée has elected to have OTLLC debt finance Entrée’s share of costs for approved programs and budgets, with interest accruing at OTLLC’s actual cost of capital or prime +2%, whichever is less, at the date of the advance. Debt repayment may be made in whole or in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée’s share of products. Available cash flow means all net proceeds of sale of Entrée’s share of products in a month less Entrée’s share of costs of Entrée/Oyu Tolgoi JV activities for the month that are operating costs under Canadian generally accepted accounting principles.

The following is a description of how Entrée recognizes its share of Oyu Tolgoi project capital costs, specifically, the timing of recognition under the terms of the JVA and generally accepted accounting principles.

Under the terms of the JVA, any mill, smelter and other processing facilities and related infrastructure will be owned exclusively by OTLLC and not by Entrée. Mill feed from the Entrée/Oyu Tolgoi JV Property will be transported to the concentrator and processed at cost (using industry standards for calculation of cost including an amortization of capital costs). Underground infrastructure on the Oyu Tolgoi mining licence is also owned exclusively by OTLLC, although the Entrée/Oyu Tolgoi JV shares usage. As a result of this, Entrée recognizes those capital costs incurred by OTLLC on the Oyu Tolgoi mining licence as an amortization charge for capital costs calculated in accordance with Canadian generally accepted accounting principles. These costs will be determined yearly and are based on the estimated tonnes of concentrate produced for Entrée’s account during that year relative to the estimated total life-of-mine concentrate to be produced (for processing facilities and related infrastructure), or the estimated total life-of-mine tonnes to be milled from the relevant deposit(s) (in the case of underground infrastructure). The charge is made to Entrée’s operating account when the Entrée/Oyu Tolgoi JV mine production is actually milled.

For direct capital cost expenditures on the Entrée/Oyu Tolgoi JV Property, Entrée recognizes its proportionate share of costs at the time of actual expenditure.

A summary of the amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence for the 2021 Reserve Case and the 2021 PEA and a summary of the Entrée/Oyu Tolgoi JV capital expenditures, including expansion and sustaining capital for the 2021 Reserve Case and the 2021 PEA are shown below.

Entrée/Oyu Tolgoi JV Property Capital Costs – 2021 Reserve Case and 2021 PEA

| 2021 Reserve Case (HNE Lift 1) |

2021 PEA (HNE Lift 2) |

||||||

| Description | Unit | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | ||

| Amortization Charges for OTLLC Capital Costs | US$ M | 701.0 | 140.2 | 201.2 | 40.2 | ||

| Mine Development & Sustaining Capital | US$ M | 275.7 | 55.1 | 1,598.6 | 319.7 | ||

Note: Capital costs are inclusive of indirect costs, Mongolian custom duties and VAT and contingency.

The average LOM operating costs for the Entrée/Oyu Tolgoi JV Property (including amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence) for the 2021 Reserve Case and the 2021 PEA and mine site cash costs for the 2021 Reserve Case and 2021 PEA are shown below.

| Description | Unit | 2021 Reserve Case (HNE Lift 1) |

2021 PEA (HNE Lift 2) |

| Average LOM cash costs after credits (C1) | US$/lb payable copper | 0.79 | 0.30 |

| Average LOM all-in-sustaining costs after credits (AISC) | US$/lb payable copper | 1.26 | 0.92 |

| Average LOM operating costs | US$/t processed | 46.01 | 28.25 |

Note: The average LOM cash cost, AISC and operating costs for the 2021 Reserve Case includes an amortization charge for OTLLC facility development capital costs. These costs will have been fully recaptured prior to processing material from HNE Lift 2; consequently, no amortization allowance for such development capital costs is payable for the 2021 PEA.

The cash flows in the 2021 Reserve Case and 2021 PEA are based on information provided by OTLLC at the time, including mining schedules and annual capital and operating cost estimates, as well as Entrée’s interpretation of the JVA terms, and certain assumptions regarding taxes and royalties.

The cash flows assume that Entrée will ultimately have the benefit of the standard royalty rate of 5% of sales value, payable by OTLLC under the Oyu Tolgoi Investment Agreement. Unless and until the December 19, 2024 partial final award of the international arbitration Tribunal is fully implemented and Entrée/Oyu Tolgoi JV stakeholders finalize agreements to convert the JVA into a more effective agreement of equivalent economic value, there can be no assurance that the Entrée/Oyu Tolgoi JV will not be subject to additional taxes and royalties, such as the surtax royalty which came into effect in Mongolia on January 1, 2011, which could have an adverse effect on Entrée’s future cash flow and financial condition. In the course of finalizing such agreements or implementing the partial final award, Entrée may have to make certain concessions, including with respect to sharing 34% of Entrée’s economic benefit derived from its interest in the Entrée/Oyu Tolgoi JV Property with the State of Mongolia.

The Entrée/Oyu Tolgoi JV Property (the "Project") is located within the Aimag (province) of Ömnögovi in the South Gobi region of Mongolia, about 570 kilometres south of the capital city of Ulaanbaatar and 80 kilometres north of the border with China.

Road access to the Project follows well-defined roads directly south from Ulaanbaatar requiring approximately 8-12 hours travel time in a four-wheel drive vehicle. OTLLC has constructed a 3.25-kilometre concrete airstrip, partially on the Entrée/Oyu Tolgoi JV Property, which is serviced by charter and scheduled flights to and from Ulaanbaatar. Ulaanbaatar has an international airport, and Tsogt Tsetsii and the Aimag capital of Dalanzadgad have regional airports.

Last Updated: June 2025

The Entrée/Oyu Tolgoi JV Property mineral reserve estimate for Hugo North Extension Lift 1 has an effective date of May 15, 2021.

Entrée/Oyu Tolgoi JV Property mineral reserves are contained within the Hugo North Extension Lift 1 block cave mining plan (see table below). The mine design work on Hugo North Lift 1, including the Hugo North Extension, was prepared by OTLLC and was used as the basis for OTFS20. The mineral reserve estimate is based on what is deemed minable when considering factors such as the footprint cut-off grade, the draw column shut-off grade, maximum height of draw, consideration of planned dilution and internal waste rock.

The mineral reserve estimate only considers mineral resources in the Indicated category and engineering that has been carried out to a Feasibility level or better to state the underground mineral reserve. There is no Measured mineral resource currently estimated within the Hugo North Extension deposit. Copper and gold grades for the Inferred mineral resources within the block cave shell were set to zero and such material was assumed to be dilution. The block cave shell was defined by a US$17.84/t net smelter return ("NSR"). Future mine planning studies may examine lower shut-offs.

Hugo North Extension Lift 1 Mineral Reserves Statement

| Entrée/Oyu Tolgoi JV Property – Mineral Reserve Hugo North Extension Lift 1 |

||||||||

| Classification | Tonnage | NSR | Cu | Au | Ag | Contained Metal | ||

| (Mt) | (US$/t) | (%) | (g/t) | (g/t) | Cu (Mlb) | Au (Koz) | Ag(Koz) | |

| Probable | 40 | 97.52 | 1.54 | 0.53 | 3.63 | 1,340 | 676 | 4,613 |

- Mineral reserves have an effective date of May 15, 2021.

- For the underground block cave, all Indicated mineral resources within the cave outline were converted to Probable mineral reserves. No Proven mineral reserves have been estimated. The estimation includes low-grade Indicated mineral resource and Inferred mineral resource assigned zero grade that is treated as dilution.

- A column height shut-off NSR of US$17.84/t was used to define the footprint and column heights. The NSR calculation assumed metal prices of US$3.08/lb Cu, US$1,292.00/oz Au, and US$19.00/oz Ag. The NSR was calculated with assumptions for smelter refining and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries, and royalties using OTLLC’s Base Data Template 38.

- Mineral reserves are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%.

- Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences.

The Entrée/Oyu Tolgoi JV Property mineral resource estimates for the Hugo North Extension and Heruga deposits have an effective date of March 31, 2021. Mineral resources are reported inclusive of those mineral resources that were converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Entrée/Oyu Tolgoi JV Property Mineral Resources

| Entrée/Oyu Tolgoi JV Property – Mineral Resources | ||||||||||

| Classification | Tonnage (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | CuEq (%) | Contained Metal | |||

| Cu (Mlb) | Au (Koz) | Ag (Koz) | Mo (Mlb) | |||||||

| Hugo North Extension (>0.41% CuEq Cut-Off) | ||||||||||

| Indicated | 120 | 1.70 | 0.58 | 4.3 | ___ | 2.04 | 4,500 | 2,200 | 16,000 | ___ |

| Inferred | 167 | 1.02 | 0.36 | 2.8 | ___ | 1.23 | 3,800 | 1,900 | 15,000 | ___ |

| Heruga (>0.41% CuEq Cut-Off) | ||||||||||

| Inferred | 1,400 | 0.41 | 0.40 | 1.5 | 120 | 0.68 | 13,000 | 18,000 | 66,000 | 370 |

- Mineral resources have an effective date of March 31, 2021.

- Mineral resources are reported inclusive of those mineral resources that were converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Metal prices used for copper equivalent (CuEq) and cut off grade calculation for both Hugo North Extension and Heruga are: US$3.08/lb Cu, US$1,292.00/oz Au and US$19.00/oz Ag. Metallurgical recoveries used for CuEq and cut-off grade calculation at Hugo North Extension are 93% for Cu, 80% for Au and 81% for Ag. Metallurgical recoveries used for CuEq and cut-off grade calculation at Heruga are 82% for Cu, 73% for Au, 78% for Ag and 60% for Mo.

- Mineral resources at Hugo North Extension are constrained within a conceptual mining shape constructed at a nominal 0.50% CuEq grade and above a CuEq grade of 0.41% CuEq. The CuEq formula is CuEq = Cu + ((Au * 35.7175) + (Ag * 0.5773)) / 67.9023 taking into account differentials between metallurgical performance and price for Cu, Au and Ag.

- The overall geometry and depth of the Heruga deposit make it amenable to underground mass mining methods. Mineral resources are stated above a CuEq grade. The CuEq formula is CuEq = Cu + ((Au * 37.0952) + (Ag * 0.5810) + (Mo * 0.0161)) / 67.9023 taking into account differentials between metallurgical performance and price for Cu, Au, Ag and Mo.

- A CuEq break-even cut-off grade of 0.41% CuEq for Hugo North Extension mineralization and covers mining, processing and G&A operating cost and the cost of primary and secondary block cave mine development.

- A CuEq break-even cut-off grade of 0.41% CuEq is used for the Heruga mineralization and covers mining, processing and G&A operating cost and the cost of primary and secondary block cave mine development.

- Mineral resources are stated as in situ with no consideration for planned or unplanned external mining dilution.

- Mineral resources are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%.

- Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences.

Last Updated: April 2022

The Technical Report can be found here

Entrée’s technical report has been filed under the Company’s SEDAR profile at www.sedar.com and updates Entrée’s 2016 technical report on the Entrée/Oyu Tolgoi JV Project filed in March 2016. The Technical Report discusses two alternative development scenarios, an updated reserve case ("2018 Reserve Case") and a Life-of-Mine ("LOM") Preliminary Economic Assessment ("2018 PEA"). The 2018 Reserve Case is based only on mineral reserves attributable to the Entrée/Oyu Tolgoi JV from Lift 1 of the Hugo North Extension underground block cave. Lift 1 of Hugo North (including Hugo North Extension) is currently in development by project operator Rio Tinto, with first development production from Hugo North Extension expected in 2021. When completed, Oyu Tolgoi will become the world’s third largest copper mine.

The 2018 PEA is an alternative development scenario completed at a conceptual level that assesses the inclusion of the Hugo North Extension Lift 2 and Heruga deposits into an overall mine plan with Hugo North Extension Lift 1. The 2018 PEA includes Indicated and Inferred resources from Hugo North Extension Lifts 1 and 2, and Inferred resources from Heruga. Significant development and capital decisions will be required for the eventual development of the two additional Entrée/Oyu Tolgoi JV deposits (Hugo North Extension Lift 2 and Heruga) once production commences at Hugo North Extension Lift 1.

Life-of-mine highlights of the production and financial results from the 2018 Reserve Case and the 2018 PEA are summarized in the table:

Summary LOM Production and Financial Results

| Entrée/Oyu Tolgoi JV Property | |||

| Units | 2018 Reserve Case | 2018 PEA | |

| LOM Processed Material | |||

| Probable Reserve Feed | 35 Mt @ 1.59% Cu, 0.55 g/t Au, 3.72 g/t Ag (1.93% CuEq) |

---- | |

| Indicated Resource Feed | ---- | 113 Mt @ 1.42% Cu, 0.50 g/t Au, 3.63 g/t Ag (1.73% CuEq) |

|

| Inferred Resource Feed | ---- | 708 Mt @ 0.53% Cu, 0.44 g/t Au, 1.79 g/t Ag (0.82 % CuEq) |

|

| Copper Recovered | Mlb | 1,115 | 10,497 |

| Gold Recovered | koz | 514 | 9,367 |

| Silver Recovered | koz | 3,651 | 45,378 |

| Entrée Attributable Financial Results | |||

| LOM Cash Flow, pre-tax | US$M | 382 | 2,078 |

| NPV(5%), after-tax | US$M | 157 | 512 |

| NPV(8%), after-tax | US$M | 111 | 278 |

| NPV(10%), after-tax | US$M | 89 | 192 |

Notes:

- Long term metal prices used in the NPV economic analyses are: copper US$3.00/lb, gold US$1,300.00/oz, silver US$19.0/oz

- Mineral reserves and mineral resources are reported on a 100% basis

- Entrée has a 20% interest in the above processed material and recovered metal

- The mineral reserves in the 2018 Reserve Case are not additive to the mineral resources in the 2018 PEA

- The CuEq formula was developed in 2016, and is CuEq16 = Cu + ((Au*AuRev) + (Ag*AgRev) + (Mo*MoRev)) ÷ CuRev; where CuRev = (3.01*22.0462); AuRev = (1250/31.103477*RecAu); AgRev = (20.37/31.103477*RecAg); MoRev = (11.90*0.00220462*RecMo); RecAu = Au recovery/Cu recovery; RecAg = Ag recovery/Cu recovery; RecMo = Mo recovery/Cu recovery. Differential metallurgical recoveries were taken into account when calculating the copper equivalency formula. The metallurgical recovery relationships are complex and relate both to grade and Cu:S ratios. The assumed metal prices are US$3.01/lb for copper, US$1,250.00/oz for gold, US$20.37/oz for silver, and US$11.90/lb for molybdenum. Molybdenum grades are only considered high enough to support potential construction of a molybdenum recovery circuit at Heruga, and hence the recoveries of molybdenum are zeroed out for Hugo North Extension. A net smelter return (NSR) of US$15.34/t would be required to cover costs of US$8.00/t for mining, US$5.53/t for processing, and US$1.81/t for G&A. This translates to a CuEq break-even underground cut-off grade of approximately 0.37% CuEq for Hugo North Extension mineralization.

The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both development options (2018 Reserve Case and 2018 PEA) Entrée is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other Oyu Tolgoi project areas owned 100% by OTLLC. Note the production and cash flows from these two development options are not additive.

Both the 2018 Reserve Case and the 2018 PEA are based on information reported within the 2016 Oyu Tolgoi Feasibility Study ("OTFS16"), completed by OTLLC on the Oyu Tolgoi project. OTFS16 discusses the mine plan for Lift 1 of the Hugo North (including Hugo North Extension) underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. Rio Tinto is managing the construction and eventual operation of Lift 1 as well as any future development of deposits included in the 2018 PEA.

Figure 1 below shows a north-south oriented, west looking cross section through the 12.4 kilometre long trend of porphyry deposits that comprise the Oyu Tolgoi project. The Entrée/Oyu Tolgoi JV Property is to the right (north) and left (south) of the central portion, the Oyu Tolgoi mining licence, held 100% by OTLLC. The deposits that are included in the mine plans for the two alternative cases, the 2018 Reserve Case and the 2018 PEA, are shown on Figure 1.

Figure 1 – Cross Section Through the Oyu Tolgoi Trend of Porphyry Deposits

Below are some of the key financial assumptions and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. All figures shown for both cases are reported on a 100% Entrée/Oyu Tolgoi JV basis, unless otherwise noted, where it is for Entrée’s 20% attributable interest. Both cases assume long term metal prices of US$3.00/lb copper, US$1,300.00/oz gold, and US$19.00/oz silver.

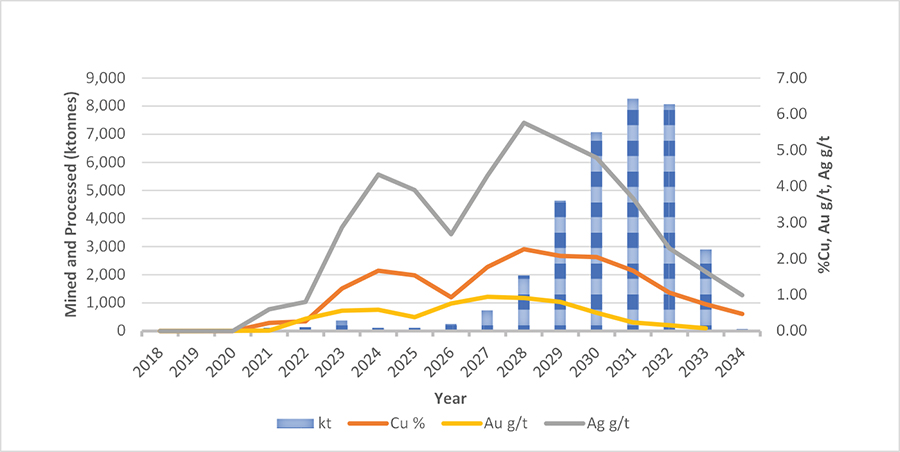

2018 Reserve Case Outputs:

- Entrée/Oyu Tolgoi JV Property development production from Hugo North Extension Lift 1 starts in 2021 with initial block cave production starting in 2026

- 14-year mine life (5-years development production and 9-years block cave production; Figure 2)

- Maximum production rate of approximately 24,000 tonnes per day ("tpd"), which is blended with production from OTLLC’s Oyut open pit deposits and Hugo North deposit to reach an average mill throughput of approximately 110,000 tpd

- Total direct development and sustaining capital expenditures of US$262 million (US$52 million attributable to Entrée)

- Entrée LOM average cash cost US$1.25/lb payable copper

- Entrée LOM average cash costs after credits ("C1") US$0.56/lb payable copper

- Entrée LOM average all-in sustaining costs ("AISC") US$1.03/lb payable copper

Figure 2 – 2018 Reserve Case (Lift 1) Mine Production

2018 PEA Outputs:

- Mineralization mined from the Entrée/Oyu Tolgoi JV Property is blended with production from other deposits on the Oyu Tolgoi mining licence to reach a mill throughput of 110,000 tpd

- Development schedule assumes for Entrée/Oyu Tolgoi JV Property (refer to Figure 3):

- 2021 start of Lift 1 development production and in 2026 initial Lift 1 block cave production

- 2028 Lift 2 development production and in 2035 initial Lift 2 block cave production

- 2065 Heruga development production and in 2069 initial block cave production

- Total direct development and sustaining capital expenditures of US$8,637 million (US$1,728 million attributable to Entrée)

- Entrée LOM average cash cost US$1.97/lb payable copper

- Entrée LOM average C1 US$0.68/lb payable copper

- Entrée LOM average AISC US$1.83/lb payable copper

Figure 3 – 2018 PEA Mine Production

Note, the 2018 PEA and the 2018 Reserve Case are not mutually exclusive; if the 2018 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 and Heruga is not sterilized or reduced in tonnage or grades. Heruga could be a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provides considerable flexibility for mine planning and development. Although molybdenum is present in the Heruga deposit, the 2018 PEA does not include the construction of a molybdenum circuit for its recovery, but it could be added in the future if economic conditions for molybdenum improve. As noted in the Turquoise Hill Resources Ltd. press release dated October 21, 2016, there are also potential opportunities for increasing the underground mining rate (and mill throughput), which would require further development and sustaining capital and different operating costs, however it would likely result in Lift 2 and Heruga mineralization being mined earlier in the overall Oyu Tolgoi mine plan and potentially improved economics for Entrée.

The cash flows in the 2018 Reserve Case and 2018 PEA are based on data provided by OTLLC, including mining schedules and annual capital and operating cost estimates, as well as Entrée’s interpretation of the commercial terms applicable to the Entrée/Oyu Tolgoi JV, and certain assumptions regarding taxes and royalties. The cash flows have not been reviewed or endorsed by OTLLC. There can be no assurance that OTLLC or its shareholders will not interpret certain terms or conditions, or attempt to renegotiate some or all of the material terms governing the joint venture relationship, in a manner which could have an adverse effect on Entrée’s future cash flow and financial condition.

The cash flows also assume that Entrée will ultimately have the benefit of the standard royalty rate of 5% of sales value, payable by OTLLC under the Oyu Tolgoi Investment Agreement. Unless and until Entrée finalizes agreements with the Government of Mongolia or other Oyu Tolgoi stakeholders, there can be no assurance that Entrée will be entitled to all the benefits of the Oyu Tolgoi Investment Agreement, including with respect to taxes and royalties. If Entrée is not entitled to all the benefits of the Oyu Tolgoi Investment Agreement, it could have an adverse effect on Entrée’s future cash flow and financial condition. For example, Entrée’s share of mineralization could be subject to a surtax royalty which came into effect in Mongolia on January 1, 2011. To become entitled to the benefits of the Oyu Tolgoi Investment Agreement, Entrée may be required to negotiate and enter into a mutually acceptable agreement with the Government of Mongolia or other Oyu Tolgoi stakeholders, with respect to Entrée’s direct or indirect participating interest in the Entrée/Oyu Tolgoi JV or the application of a special royalty (not to exceed 5%) to Entrée’s share of the Entrée/Oyu Tolgoi JV Property mineralization or otherwise.

OT is a very large project that includes four separate deposits. The long-term development of OT would involve the development of the resources on all deposits. Alternative production cases have been developed to provide early-stage analysis of the development flexibility that exists with respect to later phases of the OT project (Heruga, Hugo South, and Lift 2 of Hugo North including Hugo North Extension).

While it is outside of the scope of reserve reporting, as part of the long-term development strategy OTLLC continues to examine the alternative production cases to better define future work plans and prepare for investment decision points. The mine designs developed by OTLLC and considered in the alternative production cases include mineral reserves from the Oyut open pit (Southern Oyu) deposits and Hugo North (including Hugo North Extension) Lift 1, Indicated and Inferred mineral resources from Hugo North (including Hugo North Extension) Lift 2 and Inferred mineral resources from Hugo South and Heruga.

The mine designs noted above that are in the alternative production cases and on the Entrée/Oyu Tolgoi JV Property are:

- Hugo North Extension Lift 1 Block Cave (reserves)

- Hugo North Extension Lift 2 Block Cave (Indicated and Inferred resources)

- Heruga Block Cave (Inferred resources)

Under NI 43-101 guidelines, Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would allow them to be categorised as mineral reserves. There is no certainty that the alternative production cases will be realized.

The mine designs developed by OTLLC and considered in the alternative production cases are shown schematically in the figure below.

Figure by OreWin, 2014

Development of these deposits will require separate development decisions in the future based on the prevailing conditions and the development experience obtained from developing and operating the initial phases of OT.

The figure below shows an example of the decision tree for the possible development options at OT including the Entrée/Oyu Tolgoi JV Property. This has been updated to include options that take advantage of productivity improvements in plant throughput that have begun to be recognized in the process plant. The decision tree shows options assuming that continuous improvements in plant productivity are achieved over the next five years. Then there would be key decision points for plant expansion and the possible development of new mines at Hugo North (including Hugo North Extension) Lift 2, Hugo South, and eventually Heruga. This provides an opportunity as OTLLC will have the benefit of incorporating actual performance of the operating mine into the study before the next investment decisions are required. OTLLC plans to continue to evaluate alternative production cases in order to define the relative ranking and timing requirements for overall development options.

The initial production case, LOM 100, assumes that there is no expansion to the plant, and that Hugo North (including Hugo North Extension) Lift 1 development is followed by production from Hugo North (including Hugo North Extension) Lift 2, Hugo South and Heruga. Three alternative production cases, which assume expansion to the plant capacity, will be part of the strategic planning that is being undertaken by OTLLC. The three alternative production cases are:

- LOM 140 - Continuous improvement of plant throughput of 5.0% per year for five years.

- LOM 260 - LOM 140 plus a 100% plant expansion after approximately 20 years.

- LOM 350 - Progressive expansion of the plant to 350 ktpd.

LOM 140 assumes that there is an increase in plant throughput productivity of 5.0% per year for five years and that the Hugo North (including Hugo North Extension) Lift 1 development is followed by production from Hugo North (including Hugo North Extension) Lift 2, Hugo South and Heruga. The average throughput rate is approximately 140 ktpd or 51 Mtpa.

LOM 260 is an extension of LOM 140 and assumes that the plant capacity is doubled after approximately 20 years to an average throughput rate of 260 ktpd or 95 Mtpa.

LOM 350 assumes that there are progressive plant expansions to an ultimate rate of 350 ktpd or 128 Mtpa. With each successive expansion case there is a reduction of the mine life that would necessitate the success of further exploration to continue production. In LOM 350 this would be required to bring the exploration potential to production in approximately 30 years.

The work on the alternative production cases is not yet at Feasibility Study stage, in particular the definition of the expansion sizes and costing of the cases. OreWin Pty Ltd recommends that the options be studied further and that the timing of the new mines be defined in more detail.

Last updated: February 2018

The Oyu Tolgoi series of porphyry copper-gold deposits, which includes the Entrée/Oyu Tolgoi JV deposits, occur along a north-northeast corridor with Hugo North Extension at the north end and the Heruga deposit at the south end. Mineralization is related to Devonian quartz monzodiorite intrusions and associated quartz stockwork. The deposits have varied characteristics in regard to host rock, intrusive bodies, sulphide mineralogy, grade, and alteration.

The pre-Carboniferous stratigraphy of the Oyu Tolgoi series of deposits consists of massive augite basalt, conglomerate, dacitic tuffs, and siltstones, which are overthrust by the ‘Heruga sequence’, comprising basaltic flows, volcaniclastic rocks, and siltstones. The Carboniferous Sainshandhudag Formation unconformably overlies the older rocks. Major Carboniferous or younger faults disrupt the mineralized corridor and bound the western side of most deposits.

The pre-Carboniferous stratigraphy of the Oyu Tolgoi series of deposits consists of massive augite basalt, conglomerate, dacitic tuffs, and siltstones, which are overthrust by the ‘Heruga sequence’, comprising basaltic flows, volcaniclastic rocks, and siltstones. The Carboniferous Sainshandhudag Formation unconformably overlies the older rocks. Major Carboniferous or younger faults disrupt the mineralized corridor and bound the western side of most deposits.

Four major lithological divisions are present within the Alagbayan Group, and each of these divisions consists of two or more mappable subunits. The two lower units are commonly strongly altered and form important mineralization hosts, while the two upper units lack significant alteration and mineralization. Unit DA4 is separated from the underlying Alagbayan Group units by a contact-parallel fault, known as the Contact Fault.

The Sainshandhudag Formation is divided into three major units at Oyu Tolgoi: a lowermost tuffaceous sequence, an intermediate clastic package, and an uppermost volcanic/volcaniclastic sequence. The unit post-dates porphyry mineralization and is separated from the underlying Devonian rocks by a regional unconformity.

Intrusive rocks are widely distributed through the area and range from large batholithic intrusions to narrow discontinuous dykes and sills. At least seven classes of intrusive rocks can be defined on the basis of compositional and textural characteristics. Copper-gold porphyry mineralization is related to the oldest recognised intrusive suite, consisting of large Devonian quartz monzodiorite intrusions that occur in all of the deposit areas.

The Oyu Tolgoi project area is underlain by complex networks of poorly exposed faults, folds, and shear zones. These structures influence the distribution of mineralization by both controlling the original position and form of mineralized bodies, and modifying them during post-mineral deformation events.

Variations in bedding attitude recorded in both oriented drill core and surface outcrops define two orientations of folds: a dominant set of north-east trending folds, and a less-developed set of north-west trending folds. These folds are well defined in bedded strata of both the Sainshandhudag Formation and Alagbayan Group. They may be present in stratified rocks throughout the property, but outcrop and drillhole data are insufficient to define them in many areas. There is no evidence of a penetrative fabric (e.g., cleavage) associated with folding.

Together, the two orientations of folds form a dome-and-basin interference pattern, but it is not possible to determine their relative ages. Both of the dominant fold orientations occur in Lower Carboniferous strata, indicating that both folding events post-date mineralization.

Sedimentary facing direction indicators, including grading, scour and fill structures, load casts, and cross-bedding, are sporadically observed in drill core from along the east flank of the Hugo Dummett deposit. These suggest that parts of the Alagbayan Group are overturned. However, no large isoclinal folds have been mapped from drill core.

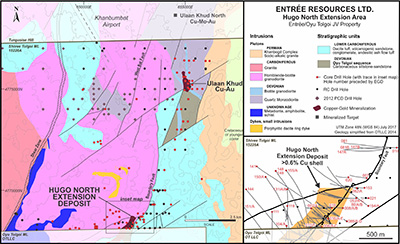

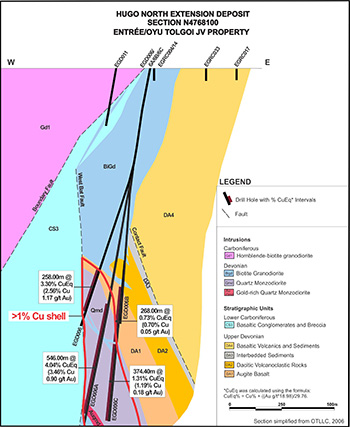

The Hugo North Extension is a term used to delimit that part of the Hugo North deposit that extends into the Entrée/Oyu Tolgoi JV Property. Based on current drilling, the Hugo North Extension deposit extends from the licence boundary north for approximately 700 metres. Beyond this only wide-spaced drilling has occurred and additional drilling will be needed to confirm whether the porphyry mineralization continues in this direction.

Entrée has a 20% interest in mineralization hosted on the Hugo North Extension deposit.

|

|

Lithologies

Host rocks at Hugo North Extension are an easterly dipping sequence of volcanic and volcaniclastic strata correlated with the lower part of the Devonian Alagbayan Group and quartz monzodiorite intrusive rocks that intrude the volcanic sequence. The Devonian stratified host rock sequence dips moderately (65° to 75°) to the east or south-east, except for a structurally induced strike flexure in the southern part of the deposit, within which dips are southward.

The stratigraphically lowest rocks in the host sequence are basalt flows and minor volcaniclastic strata, overlain by a basaltic tuff and breccia sequence. The basaltic tuff sequence has been affected by advanced argillic alteration to give it the appearance of a dacitic tuff. The host sequence basaltic volcanics are overlain by dacitic block and ash tuff and dacitic ash flow tuff. Weakly altered to unaltered sedimentary and volcanic rocks of the upper Alagbayan Group and Sainshandhudag Formation structurally overlie the mineralized sequence along the eastern flank of the deposit.

Intrusive rocks are dominated by quartz monzodiorite bodies that underlie the entire deposit area and host a significant portion of the copper and gold mineralization. Intrusive contacts are typically irregular but overall show a preferred easterly dip, sub-parallel to stratification in the overlying rocks. The quartz monzodiorites are contemporaneous with alteration and mineralization. The quartz monzodiorite is considered to be the progenitor porphyry, and two zones are distinguished on the basis of alteration characteristics and position within the deposit.

A late- to post-mineralization biotite granodiorite intrusion forms a northerly striking dyke complex cutting across the western edge and deeper levels of the deposit. At higher levels, the biotite granodiorite flares out considerably to form a voluminous body. Although this intrusion locally contains elevated copper grades adjacent to intrusive contacts or within xenolith-rich zones, it is essentially barren.

Structural Geology

The Hugo North deposit lies within easterly dipping homoclinal strata contained in a north–northeasterly elongate fault-bounded block. The northern end of this block is cut by several east-west- and northeast-striking faults near the northern boundary of the Oyu Tolgoi mining licence.

Several iterations of the structural framework have been modelled between 2007 and 2014. Deformation of Hugo North and Hugo North Extension is dominated by brittle faulting. Major faults cutting the deposit can be grouped on the basis of orientation into the following sets:

- East–west-striking, moderately north-dipping faults.

- East–west-striking, steeply dipping faults with locally varying dips between north and south. These faults offset the lithology and mineralization in oblique slip fashion (dextral displacement).

- Steep, north–northeast-striking faults. The linear mineralized trend defined by the Central, Southwest, and Hugo Dummett deposits likely reflects the presence of a deep, north–northeast-striking crustal fault or fault zone controlling magma emplacement and mineralization, termed the Axial Fault.

- North–northeast-striking, moderately east-dipping faults sub-parallel to lithological contacts.

- East–northeast-striking faults.

- Northwest striking faults that offset (oblique slip) lithologies and in some case mineralization. These faults may have an oblique slip component.

Fold styles and orientations in the Hugo North deposit are similar to those at Hugo South, with most folding restricted to the upper part of the Alagbayan Group and overlying Sainshandhudag Formation.

Mineralization

The highest-grade copper mineralization in Hugo North Extension is related to a zone of intensely stockworked to sheeted quartz veins known as the QV90 zone, so named because >90% of the rock has >15% quartz veining. The high-grade zone is centred on thin, east-dipping quartz monzodiorite intrusions or within the apex of the large quartz monzodiorite body, and extends into the adjacent basalt. In addition, moderate to high grade copper and gold values occur within quartz monzodiorite below and to the west of the intense vein zone, in the Hugo North gold zone. This zone is distinct and has a high gold (ppm) to copper (%) ratio of 0.5:1.

Bornite is dominant in the highest-grade parts of the deposit (3% to 5% copper) and is zoned outward to chalcopyrite (2% copper). At grades of <1% copper, pyrite–chalcopyrite dominates. Within the upper levels where advanced argillically altered basaltic tuff is reported, the assemblage comprises pyrite–chalcopyrite ± enargite, tennantite, bornite, chalcocite, and more rarely covellite.

The high-grade bornite zone consists of relatively coarse bornite permeating quartz and disseminations in wall rocks, usually intergrown with subordinate chalcopyrite. Pyrite is rare to absent except locally where the host rocks are advanced argillically altered. Although chalcocite is commonly found with bornite at Hugo South, it is less common at Hugo North. High-grade bornite is associated with minor amounts of tennantite, sphalerite, hessite, clausthalite, and gold that occur as inclusions or at grain boundaries.

Elevated gold grades in the Hugo North deposit occur within the up-dip (western) portion of the intensely veined, high-grade core and within a steeply dipping lower zone cutting through the western part of the quartz monzodiorite. Quartz monzodiorite in the lower zone exhibits a characteristic pink to buff colour, with a moderate intensity of quartz veining (5% to 25% by volume), and is characterised by finely disseminated bornite and chalcopyrite. Sulphides are disseminated throughout the rock in the matrix as well as in quartz veins. The fine-grained bornite has a black “sooty” appearance. Red colouration of the rock type is attributed to fine hematite dusting, primarily associated with albite.

Alteration

Hugo North Extension is characterised by copper-gold porphyry and related styles of alteration similar to those of Hugo North and Hugo South. These include biotite-K-feldspar (K-silicate), magnetite, chlorite-muscovite-illite, albite, chlorite-illite-hematite-kaolinite (intermediate argillic), quartz-alunite-pyrophyllite-kaolinite-diaspore-zunyite-topaz-dickite (advanced argillic), and sericite-muscovite zones. The distribution of alteration zones is similar to that in the Hugo South deposit except that the advanced and intermediate argillic zones are more restricted and lie mainly along the outer and upper margins of the intrusive system.

Chlorite-illite marks the outer boundary of the advanced argillic zone, mainly in the coarse, upper part of the basaltic tuff/breccia.

Quartz-pyrophyllite-kaolinite-dickite (advanced argillic) is hosted mainly in the lower part of the basaltic tuff, although on some sections at Hugo North it extends into strongly veined quartz-monzodiorite. The advanced argillic zone is typically buff or grey, and late dickite on fractures is ubiquitous. Within the advanced argillic zone, a massive quartz-alunite zone forms a pink-brown bedding-parallel lens. As with elsewhere within the property, the advanced argillic alteration is texturally destructive and often obliterates the contact between the augite basalt and overlying basaltic tuff. As a result, a diffuse lithological and mineralization contact typically characterises this zone.

Topaz is widespread as late alteration controlled by structures cutting both the advanced and intermediate argillic zone. In certain areas topaz appears to replace parts of the quartz–alunite zone. In addition, topaz may also occur disseminated with quartz–pyrophyllite–kaolinite.

Hematite–siderite–illite–pyrophyllite–kaolinite–dickite (intermediate argillic) is an inward zonation from the advanced argillic zone. It is commonly hosted by augite basalt but may also occur in basaltic ash-flow tuff. Hematite usually comprises fine specularite and may be derived from early magnetite or Fe rich minerals such as biotite or chlorite.

Hematite–chlorite–illite–(biotite–magnetite) (chlorite) is transitional to the intermediate argillic zone and is commonly hosted by augite basalt. It is characterised by a green colour and relict hydrothermal magnetite, either disseminated or in veins.

Muscovite–illite (sericite) generally occurs in the quartz-monzodiorite intrusions and is a feature of the strongly mineralized zone. Alteration decreases with depth in the quartz?monzodiorite.

At Hugo North Extension, the distribution of the alteration is strongly lithologically controlled: dacite tuff typically shows strong advanced argillic alteration, whereas basalt tends to be chlorite–muscovite–hematite altered with pyrophyllitic advanced argillic alteration in its uppermost parts. Pockets of advanced argillic alteration occur locally in the high-grade zone in the Qmd.

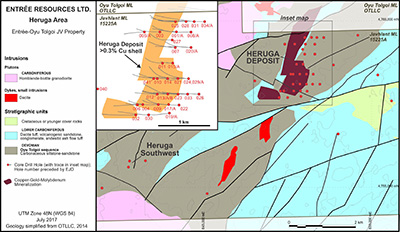

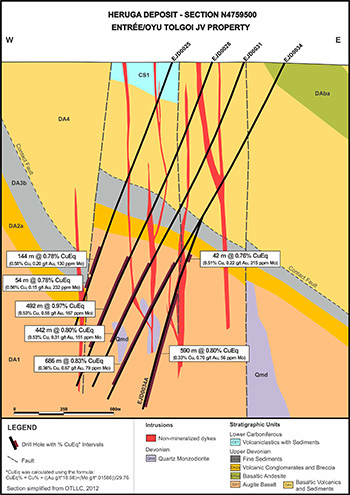

The Heruga deposit contains copper–gold–molybdenum porphyry-style mineralization and is zoned with a molybdenum-rich carapace at higher elevations overlying gold-rich mineralization at depth. The top of the mineralization starts 500 metres to 600 metres below the present ground surface. On the Javhlant mining licence, the deposit has been drilled over approximately 2 kilometres, is elongated in a north–northeast direction, and plunges to the north onto the Oyu Tolgoi mining licence.

Entrée has a 20% interest in mineralization hosted on the Heruga deposit.

|

|

Quartz monzodiorite intrudes the Devonian augite basalts as elsewhere in the district, and again are considered to be the progenitors of mineralization and alteration. Within Heruga itself, quartz monzodiorite intrusions are small compared to the stocks present in the Hugo Dummett and Oyut areas. Non-mineralized dykes, which make up about 15% of the volume of the deposit, cut all other rock types.

The deposit is transected by a series of north–northeast-trending vertical fault structures that step down 200 metres to 300 metres at a time to the west and have divided the deposit into at least two structural blocks.

Mineralized veins have a much lower density at Heruga than in the more northerly Hugo Dummett and Oyut deposits. High-grade copper and gold intersections show a strong spatial association with contacts of the mineralized quartz-monzodiorite porphyry intrusion in the southern part of the deposit, occurring both within the outer portion of the intrusion and in adjacent enclosing basaltic country rock.

At deeper levels, mineralization consists of chalcopyrite and pyrite in veins and disseminated within biotite–chlorite–albite–actinolite-altered basalt or sericite–albite-altered quartz-monzodiorite. The higher levels of the orebody are overprinted by strong quartz–sericite–tourmaline–pyrite alteration where mineralization consists of disseminated and vein-controlled pyrite, chalcopyrite, and molybdenite.

There is no oxide zone at Heruga. No high-sulphidation style mineralization has been identified to date.

Last updated: January 2018

Shivee West comprises the northwest portion of the Entrée/Oyu Tolgoi Project and is adjacent to the Entrée/Oyu Tolgoi JV Property and the Oyu Tolgoi mining licence. The area covered by Shivee West totals 23,114 hectares and is 100% owned by Entrée, subject to a first right of refusal by OTLLC.

Since 2015 Shivee West has been the subject of a License Fee Agreement between Entrée and OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi JV Property.

Past exploration activities have principally been for epithermal-style gold mineralization and porphyry-style copper-gold mineralization at Shivee West. Exploration activities have included: geophysical surveys (IP, gravity, magnetic), core drilling (38,244 metres in 65 holes), reverse circulation (RC) drilling (4,145 metres in 34 holes), trenching, geological mapping and geochemical sampling. To date, no economic zones of precious or base metals mineralization have been outlined on the Shivee West property. However, zones of gold and copper mineralization have previously been identified at Zone III/Argo Zone and Khoyor Mod. There has been no drilling on the ground since 2011, and no exploration work has been completed since 2012.

Last Updated: June 2021